By Rinki Pandey November 11, 2025

Payment Automation Experience In today’s hyper-competitive digital landscape, the quality of a customer’s interaction with a business can make or break their loyalty. From the initial browsing experience to the final post-purchase follow-up, every touchpoint matters. Yet, one of the most critical, and often overlooked, aspects of this journey is the payment process itself. A clunky, slow, or confusing payment system can lead to abandoned carts, frustrated customers, and a significant loss in revenue. This is where the strategic implementation of a modern Payment Automation Experience becomes not just a convenience, but a profound competitive advantage.

This comprehensive guide will delve into the transformative power of smart automation in revolutionizing how businesses handle transactions. We will explore how moving beyond manual processes creates a more efficient, secure, and user-friendly environment for everyone involved. By the end of this article, you will have a deep understanding of the components, benefits, and technologies that constitute a superior Payment Automation Experience, empowering you to elevate your own financial operations and foster lasting customer relationships. The journey towards a flawless financial ecosystem begins with understanding and embracing the power of a refined Payment Automation Experience.

The Evolution of Payments: From Barter to AI-Driven Transactions

To fully appreciate the significance of a modern Payment Automation Experience, it is essential to look back at the journey of commercial exchange. The history of payments is a story of continuous innovation, driven by the fundamental human need for more efficient and secure ways to transact.

The Era of Manual Invoicing and Its Pains

Not long ago, the financial back-office of most businesses was a sea of paper. Invoices were manually typed, printed, stuffed into envelopes, and mailed. Checks were received, logged by hand, and physically taken to the bank for deposit. This manual system was fraught with challenges that hindered growth and efficiency. Human error was rampant, leading to incorrect invoice amounts, misspelled names, and misdirected mail. The process was incredibly slow, extending the days sales outstanding (DSO) and creating significant cash flow bottlenecks. Furthermore, it offered little to no real-time visibility into the company’s financial health, making strategic planning a matter of guesswork. This antiquated approach was the polar opposite of a streamlined Payment Automation Experience.

The Digital Shift: E-commerce and Online Banking

The advent of the internet marked a seismic shift. E-commerce platforms and online banking began to digitize the front end of the payment process. Customers could now pay with credit cards online, and businesses could receive funds electronically. While this was a monumental step forward, it often created a disconnect. The front-end transaction might be digital, but the back-end reconciliation, reporting, and collections processes remained stubbornly manual. This hybrid model, while better than pure paper-based systems, still failed to deliver a truly integrated Payment Automation Experience, leaving significant room for operational friction and delays.

The Dawn of the Modern Payment Automation Experience

Today, we stand at the precipice of a new era. The convergence of cloud computing, Artificial Intelligence (AI), and Application Programming Interfaces (APIs) has made a truly end-to-end Payment Automation Experience an accessible reality for businesses of all sizes. This modern approach is not merely about digitizing old processes; it is about completely re-imagining them. It involves creating an intelligent, self-operating ecosystem where transactions flow seamlessly from invoicing to reconciliation without the need for constant human intervention. The focus has shifted from simply processing payments to creating a holistic Payment Automation Experience that adds value at every step.

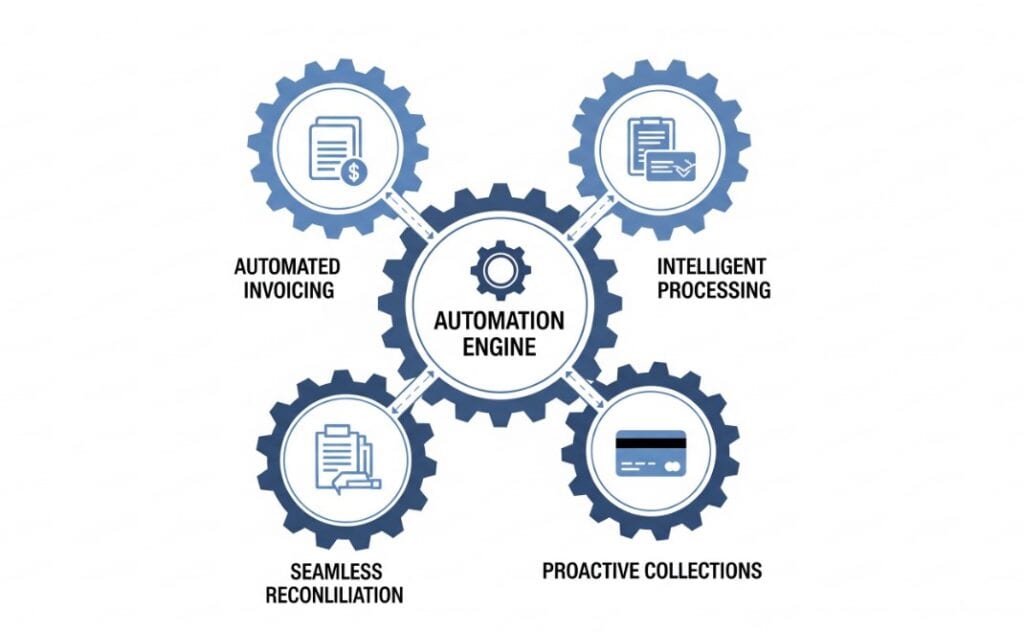

Understanding the Core Components of a Modern Payment Automation Experience

A truly effective Payment Automation Experience is not a single product but a cohesive system of interconnected components working in harmony. Each element addresses a specific part of the payment lifecycle, collectively creating an engine of financial efficiency.

Automated Invoicing and Billing

This is the foundational layer. Smart automation systems can connect directly to your CRM or ERP to generate and send invoices automatically based on predefined triggers, such as a completed project, a product shipment, or a subscription renewal date.

- Accuracy: Automation eliminates the human error associated with manual data entry, ensuring every invoice is correct.

- Speed: Invoices are sent instantly, dramatically reducing the time it takes to get them into the hands of your customers.

- Customization: Templates can be customized with branding and personalized messages, enhancing the professional appearance of your communications and improving the overall Payment Automation Experience.

- Flexibility: These systems easily handle complex billing scenarios, including prorated charges, usage-based billing, and recurring subscriptions.

Intelligent Payment Routing and Processing

Once an invoice is sent, the system provides customers with multiple, convenient ways to pay (credit card, ACH, digital wallets). Behind the scenes, intelligent routing technology can optimize the transaction process. For instance, it might route certain types of payments through the lowest-cost processor, saving the business significant money on fees over time. This backend intelligence is a hallmark of a sophisticated Payment Automation Experience.

Seamless Reconciliation and Reporting

This is where automation delivers one of its most significant benefits. Instead of manually matching payments received in the bank account to outstanding invoices in the accounting software, an automated system does it instantly.

- Real-time Visibility: The system provides an up-to-the-minute view of cash flow and accounts receivable.

- Reduced Workload: It frees up accounting teams from hours of tedious, repetitive work, allowing them to focus on more strategic financial analysis.

- Error Elimination: Automatic matching removes the risk of reconciliation errors that can consume days of work to track down and fix. This contributes to a reliable Payment Automation Experience.

Proactive Dunning and Collections Management

Chasing late payments is a resource-draining and often uncomfortable task. A superior Payment Automation Experience includes automated dunning management. The system can be configured to send a series of polite, timed payment reminders to customers with overdue invoices. This process is more consistent and often more effective than manual follow-ups, improving collection rates without straining customer relationships. A great Payment Automation Experience helps a business get paid faster.

The Tangible Business Benefits of Investing in a Superior Payment Automation Experience

Implementing a robust Payment Automation Experience is more than an IT upgrade; it’s a strategic business decision that yields substantial returns across the organization. The benefits extend far beyond the finance department, impacting everything from operational efficiency to customer satisfaction. Investing in a leading Payment Automation Experience is investing in the future health of your company.

Drastically Reduced Operational Costs

The most immediate and measurable benefit is the reduction in costs associated with manual labor. Think of the hours your team spends creating invoices, sending reminders, processing payments, and reconciling accounts. Automation handles these tasks in a fraction of the time, for a fraction of the cost.

- Lower Labor Costs: Reduces the need for dedicated staff to manage routine AR tasks.

- Elimination of Material Costs: Saves money on paper, printing, and postage.

- Reduced Processing Fees: Smart routing can minimize transaction fees.

The efficiency gained through a better Payment Automation Experience directly impacts the bottom line.

Enhanced Cash Flow and Financial Predictability

By accelerating the entire invoice-to-cash cycle, automation directly improves a company’s cash flow. Invoices go out faster, and automated reminders encourage prompt payment, significantly reducing Days Sales Outstanding (DSO). This creates a more predictable and reliable revenue stream, which is crucial for budgeting, forecasting, and strategic investment. A predictable Payment Automation Experience gives leaders the confidence to make bold decisions.

Fortified Security and Compliance

Handling sensitive payment data manually is inherently risky. A piece of paper can be lost, an email can be intercepted, and human error can lead to data breaches. Modern payment automation platforms are built with security at their core.

- PCI DSS Compliance: These systems are designed to meet the rigorous Payment Card Industry Data Security Standard, protecting cardholder data.

- Tokenization and Encryption: Sensitive information is encrypted and replaced with secure tokens, meaning you never have to store raw credit card details on your servers.

- Reduced Internal Fraud: Automation limits the number of employees who need to handle sensitive financial information, reducing the opportunity for internal fraud. A secure Payment Automation Experience builds trust with your customers.

Unlocking Data-Driven Strategic Insights

Every transaction contains a wealth of data. Manual systems make it nearly impossible to extract and analyze this information effectively. An automated system, however, captures every data point and presents it through intuitive dashboards and reports. This allows business leaders to:

- Identify payment trends among different customer segments.

- Recognize which payment methods are most popular.

- Pinpoint customers who are consistently late payers.

- Forecast future cash flow with much greater accuracy.

This transformation of raw data into actionable intelligence is a key advantage of a comprehensive Payment Automation Experience. It turns the finance department from a cost center into a strategic partner for business growth. The insights derived from a superior Payment Automation Experience can guide future business strategy.

Key Technologies Powering the Future of Payment Automation Experience

The remarkable capabilities of modern payment automation are not magic; they are the result of several powerful technologies working in concert. Understanding these underlying technologies helps to appreciate the sophistication of a top-tier Payment Automation Experience.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are the brains behind the smartest automation platforms. Machine learning algorithms can analyze historical payment data to predict which customers are likely to pay late, allowing the system to take proactive measures. AI can also power intelligent cash application, accurately matching incoming payments to multiple open invoices even when remittance information is missing or unclear. This level of intelligence elevates a standard system into a truly adaptive Payment Automation Experience.

Robotic Process Automation (RPA)

RPA involves using software “bots” to perform repetitive, rules-based digital tasks that were previously done by humans. In the context of payments, RPA can be used to log into a vendor portal, download an invoice, extract the relevant data using optical character recognition (OCR), and enter it into the accounting system for payment, all without human intervention. This technology is a workhorse that underpins much of the efficiency of the Payment Automation Experience.

Application Programming Interfaces (APIs)

APIs are the essential glue that connects different software systems. In the world of payments, APIs allow your invoicing platform to communicate seamlessly with your CRM, your ERP, your bank, and various payment gateways. This seamless integration is what enables the end-to-end automation that defines a modern Payment Automation Experience. A well-architected API strategy ensures that data flows freely and accurately across your entire tech stack, eliminating data silos.

Blockchain and Distributed Ledger Technology (DLT)

While still an emerging technology in this space, Blockchain holds immense promise for the future of the Payment Automation Experience. Its decentralized and immutable nature offers the potential for near-instant, highly secure, and transparent cross-border payments. By eliminating intermediaries, DLT could drastically reduce transaction costs and settlement times, representing the next frontier in the evolution of the Payment Automation Experience.

How to Implement a Successful Payment Automation Experience Strategy

Transitioning to an automated system requires careful planning and a strategic approach. Simply buying a piece of software is not enough; success depends on a thoughtful implementation process that aligns technology with your business objectives. Crafting the right Payment Automation Experience is a multi-step journey.

Step 1: Assess Your Current Payment Ecosystem

Before you can build the future, you must understand the present. Conduct a thorough audit of your existing processes.

- Map out the entire journey from invoicing to reconciliation.

- Identify bottlenecks, pain points, and areas of high manual effort.

- Calculate your current DSO and the average cost per invoice.

- Gather feedback from your finance team and your customers.

This baseline analysis will be crucial for defining your goals and measuring the success of your new Payment Automation Experience.

Step 2: Define Clear Objectives and Key Performance Indicators (KPIs)

What do you want to achieve with automation? Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Examples include:

- Reduce DSO by 20% within six months.

- Decrease the cost of invoice processing by 50% within one year.

- Eliminate 95% of manual reconciliation errors.

- Improve customer satisfaction scores related to billing by 15%.

These KPIs will guide your selection of technology and provide clear benchmarks for success. Your entire team should be aligned on the objectives for the new Payment Automation Experience.

Step 3: Choose the Right Technology Partner

Selecting a vendor is a critical decision. Look for a partner, not just a product.

- Scalability: Can the platform grow with your business?

- Integration: Does it offer pre-built integrations with your existing ERP, CRM, and accounting software?

- Security: What are its security credentials and compliance certifications?

- User Experience: Is the platform intuitive for both your team and your customers? A good user interface is vital for a positive Payment Automation Experience.

- Support: What level of customer support and training do they offer?

Step 4: Phased Implementation and Employee Training

Avoid a “big bang” approach. A phased rollout allows you to manage the transition more effectively and minimize disruption. Start with a specific process or a single department, learn from the experience, and then expand. Crucially, invest in comprehensive training for your employees. Help them understand that the new Payment Automation Experience is a tool to empower them, not replace them. Teach them how to manage the system and leverage the data it provides.

Step 5: Monitor, Analyze, and Optimize Continuously

The launch is not the finish line. A Payment Automation Experience is a dynamic system that should be continuously improved.

- Regularly monitor your KPIs to track progress against your goals.

- Solicit feedback from users to identify areas for improvement.

- Stay informed about new features and best practices from your technology partner.

- Continuously look for new ways to leverage automation to further streamline your financial operations.

An optimized Payment Automation Experience is one that evolves with your business needs.

Comparing Manual vs. Automated Payment Processes

To visualize the profound impact of this shift, the following table breaks down the key differences between traditional and automated approaches.

| Feature/Process | Manual Process | Automated Process (Superior Payment Automation Experience) |

| Invoice Creation | Manual data entry from multiple sources; prone to errors and delays. | Automatic generation from ERP/CRM data; instant and 100% accurate. |

| Invoice Delivery | Printing, stuffing envelopes, mailing; takes 3-7 business days. | Instant electronic delivery via email with a “Pay Now” link. |

| Payment Collection | Waiting for checks to arrive by mail; manual processing. | Multiple online payment options (Credit Card, ACH); funds received instantly. |

| Payment Reminders | Manual calls and emails; inconsistent, time-consuming, and often delayed. | Automated, scheduled reminders sent based on predefined rules; consistent and polite. |

| Payment Reconciliation | Manually matching bank statements to invoices; takes hours or days. | Automatic, real-time matching of payments to invoices within the accounting system. |

| Data & Reporting | Data is siloed and requires manual compilation for reports; often outdated. | Real-time dashboards and customizable reports providing actionable financial insights. |

| Security | Relies on physical security and manual protocols; high risk of data exposure. | PCI DSS compliant, tokenization, and encryption; fortified against breaches and fraud. |

This table clearly illustrates how a well-implemented Payment Automation Experience transforms every aspect of the accounts receivable lifecycle.

The Human Element: How Automation Elevates Customer and Employee Satisfaction

While the discussion often centers on technology and efficiency, it’s crucial to remember that the ultimate goal of a superior Payment Automation Experience is to improve the lives of people—both your customers and your employees.

For Customers: Frictionless and Personalized Journeys

Today’s customers expect convenience and control. A clunky payment process is a major point of friction that can sour an otherwise positive relationship.

- Convenience: A great Payment Automation Experience offers customers a self-service portal where they can view their invoice history, manage payment methods, and make payments 24/7 from any device.

- Choice: It provides a variety of payment options, allowing customers to pay in the way that is most convenient for them.

- Transparency: Customers have clear, real-time visibility into their account status, eliminating confusion and the need to contact customer support for simple billing questions.

By making the payment process effortless and transparent, you show your customers that you value their time, which builds trust and fosters long-term loyalty. The quality of the Payment Automation Experience is a direct reflection of your brand’s commitment to customer service.

For Employees: From Tedious Tasks to Strategic Roles

Automation is not about replacing employees; it’s about elevating them. By freeing your finance and accounting teams from the drudgery of manual, repetitive tasks, you empower them to focus on higher-value activities.

- Strategic Analysis: Instead of matching payments, they can analyze payment trends to identify opportunities for business growth.

- Customer Relationships: They can spend more time building relationships with key clients, perhaps working on flexible payment plans for strategic accounts.

- Process Improvement: They have the time to think critically about how to further optimize the financial operations of the business.

This shift not only improves job satisfaction and reduces employee burnout but also transforms your finance team into a proactive, strategic asset. A well-designed Payment Automation Experience is a catalyst for professional development and a more engaged workforce. The future of work is collaborative, with humans and technology working together to achieve a better Payment Automation Experience for all stakeholders.

Conclusion: Embracing the Future of Financial Operations

The shift from manual, error-prone payment processing to a smart, streamlined Payment Automation Experience is one of the most impactful transformations a modern business can undertake. It is the key to unlocking new levels of operational efficiency, strengthening financial security, and enhancing both customer and employee satisfaction. By reducing costs, accelerating cash flow, and providing invaluable data-driven insights, a superior Payment Automation Experience lays the foundation for sustainable growth and a powerful competitive edge.

The journey begins with a commitment to move beyond the status quo and a strategic plan to leverage the right technologies. By focusing on a holistic, end-to-end Payment Automation Experience, businesses can ensure that the critical act of getting paid is no longer a source of friction, but a seamless, positive, and value-adding interaction that strengthens relationships and propels the organization forward into a more profitable and predictable future. The time to invest in a superior Payment Automation Experience is now.

Frequently Asked Questions (FAQ)

1. What is a Payment Automation Experience?

A Payment Automation Experience refers to the end-to-end ecosystem of technologies and processes used to manage the entire payment lifecycle without manual intervention. It encompasses everything from automated invoice generation and delivery to digital payment processing, automatic reconciliation, and proactive collections management. The goal is to create a seamless, efficient, and secure experience for both the business and its customers.

2. Is payment automation only suitable for large enterprises?

No, absolutely not. While large enterprises were early adopters, the rise of cloud-based SaaS (Software as a Service) solutions has made a sophisticated Payment Automation Experience accessible and affordable for businesses of all sizes, including small businesses and startups. These platforms are scalable, allowing you to start small and expand capabilities as your business grows.

3. Will implementing payment automation replace my accounting team?

The goal of automation is to augment, not replace, your team. It handles the repetitive, low-value tasks like data entry and reconciliation, which frees up your skilled finance professionals to focus on higher-value strategic activities. This includes financial analysis, forecasting, managing customer relationships, and process optimization. A good Payment Automation Experience makes your team more effective and valuable.

4. How secure are automated payment systems?

Reputable payment automation platforms are built with multi-layered security as a top priority. They adhere to strict industry standards like PCI DSS to protect sensitive cardholder data. They use advanced security technologies like tokenization and end-to-end encryption, which are significantly more secure than manual processes like handling paper checks or storing credit card numbers in a spreadsheet.

5. How long does it take to implement a new Payment Automation Experience?

The implementation timeline can vary depending on the complexity of your existing systems and the solution you choose. Modern, cloud-based platforms with pre-built API integrations can often be set up in a matter of weeks, not months. A phased implementation approach, where you automate one process at a time, can also help to manage the transition smoothly and start realizing benefits more quickly.

Leave a Reply